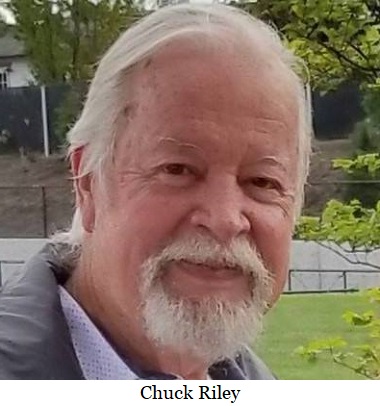

Senators Chuck Riley (D-Hillsboro) and Rob Wagner (D-Lake Oswego) are chief sponsors of SB 299 that authorizes the creation of children’s service districts. The bill provides authority to levy permanent property taxes and other taxes, and allows anyone to challenge a levy claiming it exceeds the education property tax limit. You might think that it will bring in more funds for children services, but that would be wrong.

Special Districts Association of Oregon says, “new children’s districts are unnecessary, duplicative and costly… has the effect of limiting the capacity of existing taxing jurisdictions in meeting their responsibilities.” It pits districts and services against each other with no guarantee of the ability to meet educational needs.

Mark Gharst’s testimony on behalf of local governments, explains:

“Adding more taxing districts could lead to compression and those already in compression would see compression increases if children’s districts are created and added to the tax rolls. (Compression is a reduction in taxes that would otherwise be levied but must be reduced due to the 1990 Measure 5 caps of $5 for education and $10 for local government.) According to the Department of Revenue, tax year 2019-20 compression losses totaled about $129 million. Twenty districts, mostly cities and schools, lost more than 10 percent of the taxes that would have otherwise been owed. Seven districts had more than 20 percent of their taxes compressed.”

In order to meet Measure 5 requirement as determined in Urhausen v. City of Eugene, Senator Riley proposed -1 amendment. The court concluded that aggregate levies that exceeded the education cap had to be returned. The amendment tries to avoid the return by using it for non-education services.

“If an action is filed asserting a valid claim that any revenue of the children’s service district is subject to the $5 limitation per $1,000 of real market value under Article XI, section 11b, of the Oregon Constitution, because the revenue funds a project constituting educational services, including support services, the children’s service district shall discontinue the project and shall instead use the revenue for a project that does not constitute educational services, including support services, within the meaning of Article XI, section 11b, of the Oregon Constitution.”

In the court case, Eugene was ordered to return the funds, but under the amendment it would be used for other purposes that voters didn’t authorize. Instead of compressing educational services, it would compress local government services. The services authorized under SB 299 are already or can be provided by existing school districts, cities, counties and special districts. It takes the greater of ten percent or 100 electors to file a petition for formation of a children’s service district. The consequence of a maximum property tax is that the more services added as a levy, the less each service receives.

–Donna Bleiler

https://northwestobserver.com/index.php?ArticleId=1031

Date: 2021-03-05 05:15

No tags for this post.