Last week a draft bill has been introduced in the Legislative Revenue Committee and it deals with Oregon income taxes. The draft bill (LC 1581) is very simple, it requires the State Capitol Revenue Office to study Oregon’s income tax and make recommendations to lawmakers.

Here are 4 reasons why you should concerned.

#1. Legislative studies are the first step to passing massive taxes: Years prior, the Legislature passed a bill to study a Carbon Tax. They spent a quarter million of taxpayer dollars (!) and the final product was a Carbon Tax idea that was the nation’s most restrictive Carbon Tax plan. The politicians tried to pass it but were stopped by walk-out protests of the minority party (Republican) lawmakers and the the massive citizen protest created by Timber Unity. Previously, the Legislature studied education funding and their final result was Oregon’s biggest tax in its history (Corporate Activities Tax). Once the Legislature uses tax dollars to study something you can bet (by past example) the study will produce the most expensive and costliest solution. This means your taxes are going up. This is how it works.

#2. The tax bill is anonymous. The draft bill to study the Oregon income tax comes out of a committee where the lawmaker who created the idea and wrote the bill is not known and hidden from the public. This is an unfortunate yet common practice in the State Capitol and had been criticized by the media, lawmakers and citizens for many years. When a bill is a bad idea, the author hides from the public. No single lawmaker wants to have their name on an income tax increase.

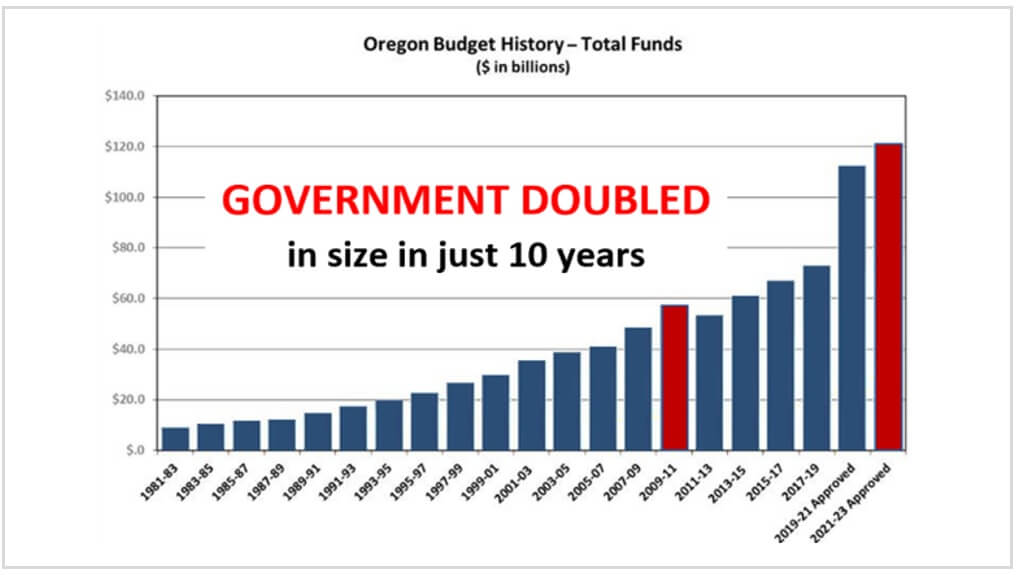

#3. The 2023 recession changes everything. The State Economist predicted a 2023 recession for Oregon. Now look at the chart below. Ask yourself, how is State Government going to keep up their skyrocketing non-stop record-breaking streak of ballooning budgets if we run into a recession?

If you don’t think lawmakers are planning taxes to handle the recession, then ask yourself where in the media have you heard the lawmakers talk about the cuts they plan to do?

#4. Looming PERS pension crisis: The Oregon Public Employee Retirement System (PERS) pension fund is $24 billion in debt. The system has been in debt during America’s longest and best stock market years. How much will a near-bankrupt PERS system perform when the stock market is not breaking records every year? The lavish PERS system guarantees over 7% investment returns no matter how stocks and bonds perform. PERS has to make massive payouts even when a recession hits. The politicians must find new tax revenue and they will likely target income tax increases.

This tax study bill could become something innocent or helpful, but we are not going to ignore it. If you wish to study income tax reform we suggest forming a task force that is bipartisan and represents all viewpoints. Or you can save time by simply doing what the most successful examples have done which is to cut taxes which has shown over-and-over again to boost both taxpayer income and government revenue. A win-win for everyone. The Taxpayers Association of Oregon will be vigilantly tracking it and working to cut taxes and not wasting near-millions of tax dollars pushing new taxes on a wounded Oregon Middle class.

Posted in the Oregon Catalyst by Taxpayers Association of Oregon, OregonWatchdog on 12/14/22

Date: 2022-12-16 10:54