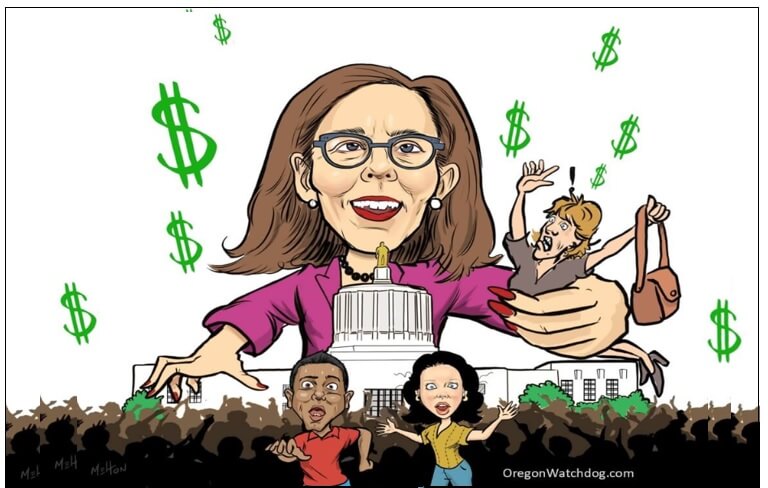

Tax Increase Notice: These are the most active and debated tax bills in the 2021 Legislature

#1. Quarter Billion Dollar Homeowner Tax, Marriage Penalty — SB 852 eliminates the home mortgage interest deduction (the nation’s most-used tax incentive) for higher income earners, eliminates the deduction for all owners of a second home, and ends up unfairly taxing some married couples more than singles.

#2. Revoking Covid Tax Relief — HB 2457-1 eliminates three different business tax relief portions of the 2020 bipartisan congressional CARES Act aimed to aid businesses affected by the government shutdown.

#3. Carbon Tax — HB 2021 requires utilities to reduce baseline emissions levels by 100%. Based on California carbon reduction models this could increase your home electricity bills by 45%.

#4. Income Tax Increase — HB 3328 creates a new income tax to fund wildlife programs.

#5. Kicker Income Tax Refund Reduction — SB 846(a) diverts $15 million in kicker income tax refunds from going to taxpayers and sends it into the general fund budget. Kicker funds are surplus tax revenue that has been over-collected by the state. This bill passed both chambers.

#6. 3,000% Alcohol Tax — The alcohol tax plan (a tax on various alcohol products up to 3,000%) did not have a hearing. Instead, the authors are creating a statewide task force to consider different tax rates and ways to reduce “excessive” drinking in Oregon by 15%.

#7. Three Timber Taxes — HB 2379, HB 2598, and HB 2389 impose new taxes and increase current timber taxes by as much as 8%.

#8. Mattress Tax — SB 570 requires a mattress tax on every mattress sale to fund a “mattress stewardship” program.

#9. Late Surprise Business Tax — Oregon Governor Kate Brown put into her Official 2021 budget blueprint a small businesses tax by raising the income tax rates of family owned businesses (LLCs and other pass-through entities.). No bill number has emerged, but it may occur as a late gut-and-stuff at the end of Session when taxes are fast-tracked through the process.

Posted in the Oregon Catalyst, on 5-3-21

Date: 2021-05-04 08:29

No tags for this post.