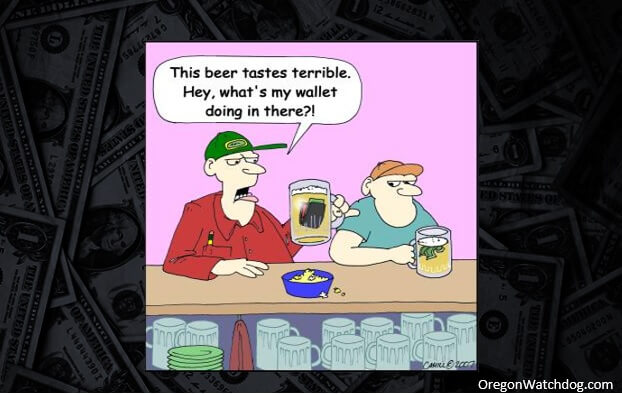

Sipping a glass of wine and drinking a beer could cost a lot more in Oregon under a proposed bill that would increase alcohol taxes by as much as 3,000 percent to pay for substance abuse prevention and treatment programs.

Reps. Tawna Sanchez (D-Portland) and Rachel Prusak (D-Tualatin/West Linn) sponsored House Bill 3296 to boost the wholesale tax on beer and cider from $2.60 a barrel to $72.60—a jump of 3,000 percent—and raise the wine tax from 65 cents to $10.65 per gallon, a boost of 2,000 percent, according to the Portland Business Journal.

This 3000% alcohol tax could come on top of the Gov. brown’s $273 million small business tax which would hit some local brewers twice with new taxes!

Recovery advocates say the tax increases would curtail the consumption of harmful addictive substances and raise hundreds of millions of dollars for addiction treatment and prevention programs. Oregon has the nation’s third highest untreated addiction rate, and in 2018, Gov. Kate Brown declared addiction a public health crisis.

Oregon’s beverage industries describe these taxes as a great start in killing the Oregon beer, wine, and cider sectors.

Published in the Oregon Catalyst, Feb 25, 2021

Date: 2021-02-25 10:00